HomeBank is a free, easy-to-use personal finance management software that helps users organize their finances, create budgets, and track spending. Whether you are looking to manage household expenses or track your income, HomeBank provides the tools you need to stay on top of your finances. Follow this step-by-step guide to get started:

1. Download and Install HomeBank

- Visit the official HomeBank website download page.

- Choose the version that matches your operating system (Windows, GNU/Linux, Mac OS or Android).

- Download and install the software by following the on-screen instructions.

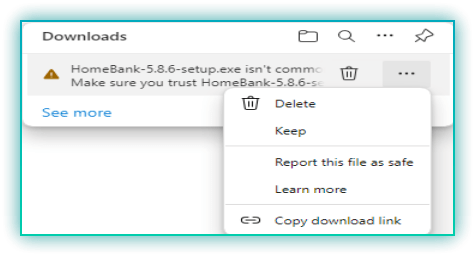

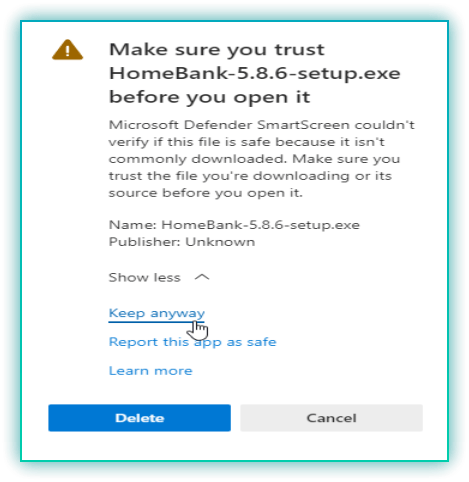

You may get a warning, just click on keep

Show more and Keep anyway.

Open file

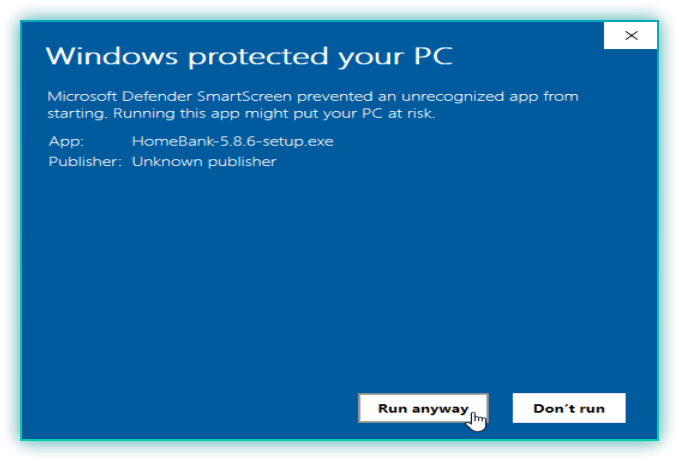

If you get this pop-up click on more info and run anyway

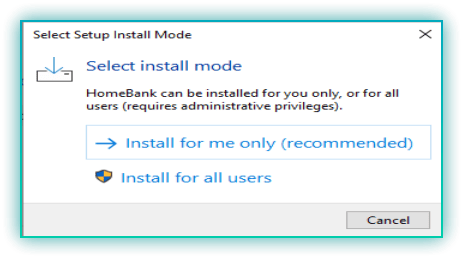

Choose if you want to install only for yourself or all users on the device

I will not add any more screenshots for the rest of the installation as you can just take the defaults or modify if needed. It is no different than most software installations.

2. Set Up Your Accounts

After installing HomeBank:

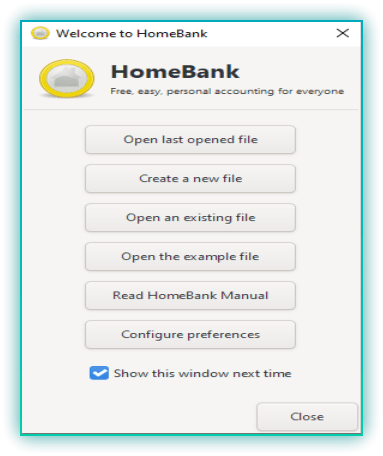

Open the application and you will be greeted with a welcome dialog to set up your accounts. Choose create a new file.

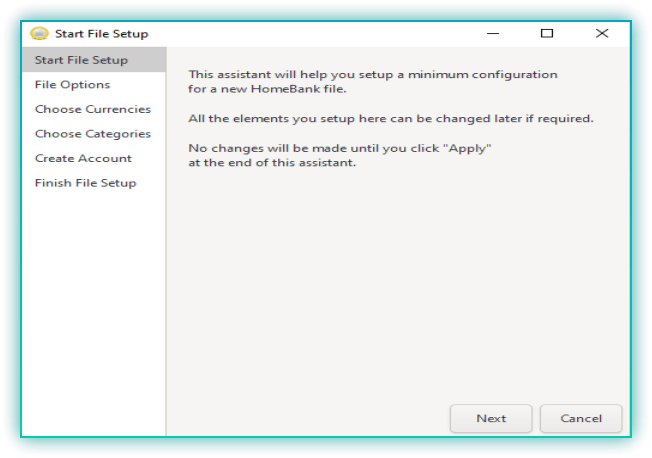

Click on next

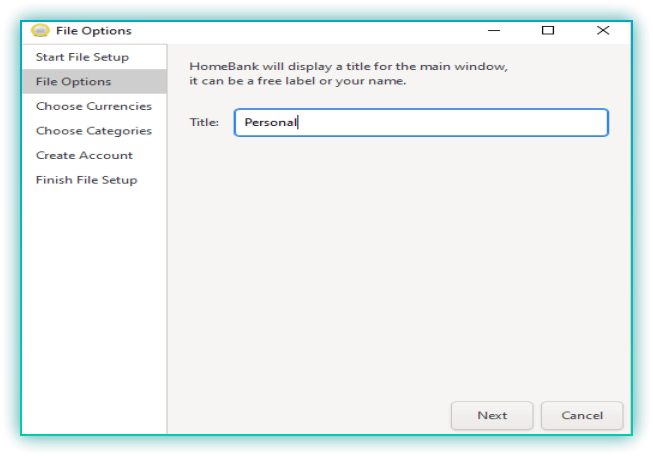

Give it a title and click next

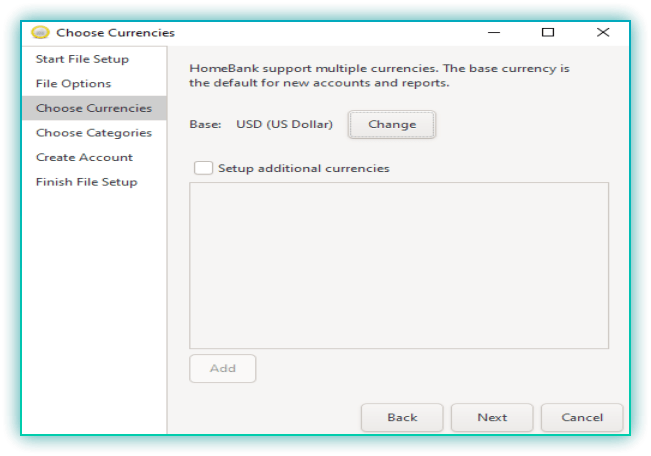

Choose your currency or multiples if you wish and click next

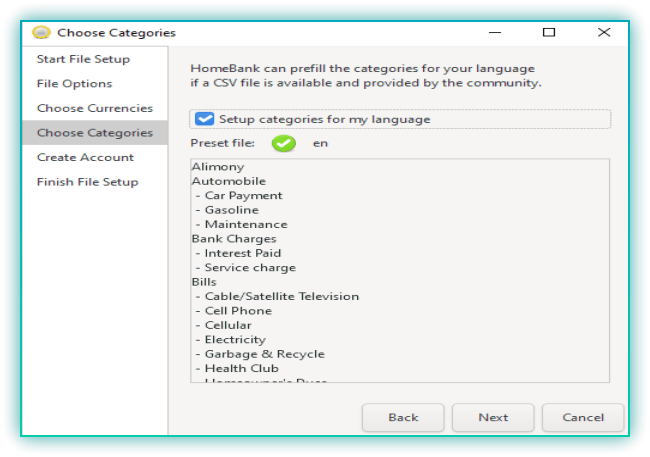

It will prefill the categories (these can be modified later) Click next

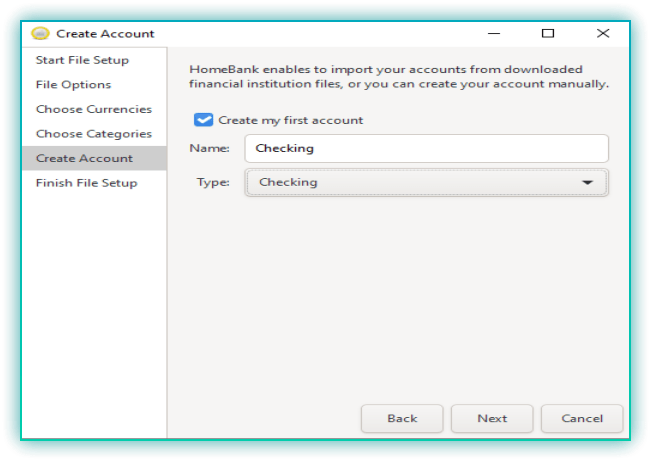

Create your first account by giving it a name and choosing the type from the dropdown then click on next

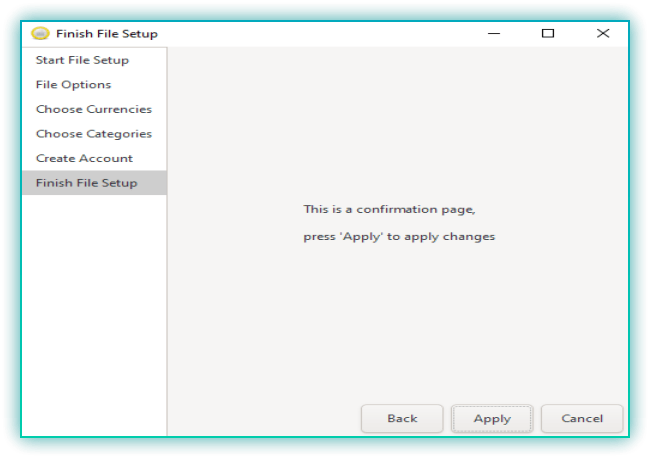

You have now set up your first account and can click apply

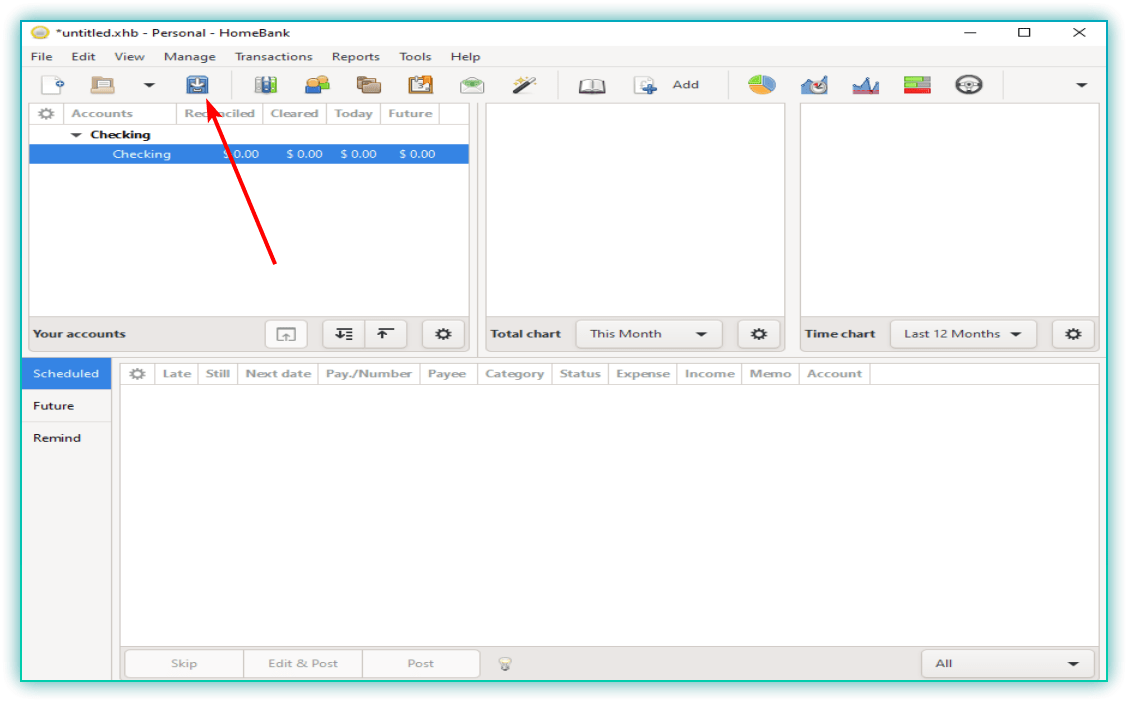

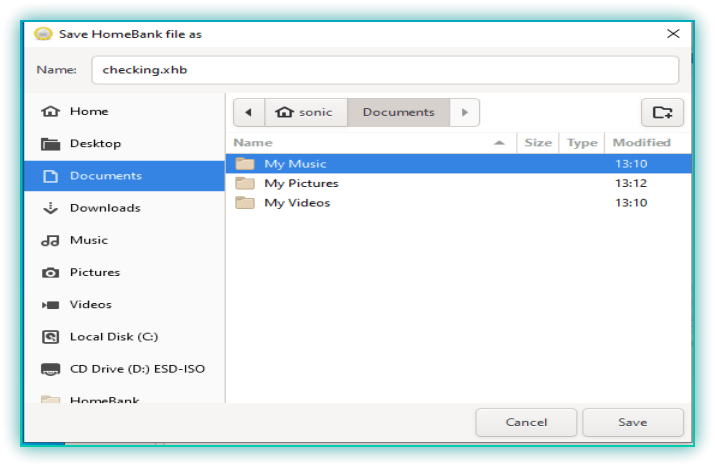

Before we do anything we need to save what we have done so far. This step is how we backup our accounts. You can click on file > save as or you can just click on blue button with a down arrow on it.

On the left side choose where you want to download it. I will choose Documents and name it checking. The back up extension for homebank is .xhb. Click save.

Now every time you click on the button it will save it in that location. I recommend backing this info up in case you ever need to restore it. To encrypt and back up with automation please read Our Guide

Tip: Set up all your accounts for a complete financial overview.

3. Import Transactions

To save time, import your bank statements:

- Download your bank statements in compatible formats (e.g., CSV, QIF, or OFX).

- Go to File > Import in HomeBank and select the appropriate file.

- Map the imported data to the correct accounts and categories.

Alternatively, you can manually add transactions by selecting Transactions > New Transaction.

4. Categorize Your Expenses

Proper categorization is key to effective budgeting:

- HomeBank automatically provides default categories such as groceries, utilities, and entertainment.

- Add custom categories by selecting Manage > Categories.

- Assign categories to each transaction to track your spending patterns.

5. Create a Budget

- Navigate to Tools > Budget.

- Select the categories you want to include in your budget.

- Define monthly or yearly spending limits for each category.

- Save the budget and review it regularly.

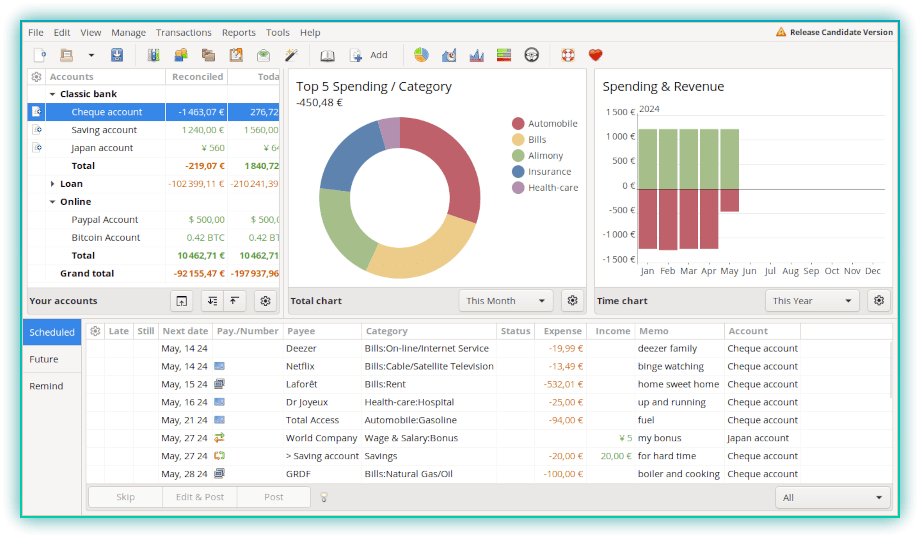

6. Track Your Spending

HomeBank provides various tools to monitor your finances:

- Use the Statistics view to analyze spending trends by category.

- Check the Balance view to see your current account balances.

- Generate Reports to visualize income, expenses, and budget adherence.

7. Set Up Alerts

- Configure alerts to notify you of budget overruns or low account balances.

- Go to Tools > Preferences and set thresholds for alerts.

- Enable notifications to stay informed about your financial activity.

8. Backup Your Data

Regularly back up your HomeBank data to prevent loss:

- Go to File > Save As and save your file to a secure location.

- Use cloud storage services or external drives for added security.

9. Tips for Maximizing HomeBank’s Features

- Reconcile accounts monthly to ensure accuracy.

- Use tags for detailed tracking of specific events or projects.

- Experiment with different report types to gain deeper financial insights.

Conclusion

Using HomeBank will at the very least, provide insight to where your money has been going. Powerful graphs lay it out in easy to visualize spending summaries. But do not stop there. The real power over your money comes when you create the budget and stick to it. You tell your money where to go instead of it just disappearing. Set up the scheduled transactions for things that come out monthly like your rent or house payment. This helps you in creating the budget because you have a scheduled transaction for your paychecks as well as what needs to come out for bills. And to help you stay on that budget….it is free. But as you get on track don’t forget to budget a donation because you will appreciate what this software can do for you.

HomeBank is a powerful tool for taking control of your finances. By setting up accounts, creating budgets, and tracking spending, you can gain valuable insights into your financial habits and achieve your monetary goals. Start using HomeBank today and make informed decisions about your financial future!

Find more on https://notposted.com

No Comments on "HomeBank Budgeting and Spending Tracking: A Simple Guide"